TANF Spending on Child Welfare

Fifteen states spend 1/5+ of TANF on Child Welfare

GAO Examines TANF & Child Welfare

On April 8, 2025 the U.S. Ways and Means Subcommittee on Work and Welfare held an oversight hearing on Temporary Assistance for Needy Families (TANF).

Hearing Focus: TANF’s accountability and fraud risks, with testimony from multiple U.S. Government Accountability Office experts and an OH county agency director.

TANF Concerns: GAO’s report notes that 37 states have 162 TANF audit findings. One third fell into the highest category of audit concern.

Findings showed audit concerns persisted too; over three dozen findings were unresolved after 2+ years, and some lasted over a decade.

GAO noted it has previously raised concerns around HHS support of state audit resolutions, enforcement action, and fraud risk assessment.

TANF is overseen by the Office of Family Assistance, which has lost 40% of its staff, including those that distribute TANF funds to states.

We don’t yet know how these changes will impact program oversight and integrity.

TANF Complexity: TANF's structure includes “assistance” (direct financial support) and “non-assistance” (everything else). The complex eligibility rules for assistance drive increasing shifts toward non-assistance.

New Child Welfare & TANF Report Drops: GAO also released a new report looking at how TANF works with other federal funds to support child welfare services.

Report Findings: The report highlights the central role of TANF in federal child welfare financing. It notes that from FY2015-FY2022, states reported :

$68.6 billion in Title IV-E spending;

$4.4 billion in Title IV-B funding; and

$23.5 billion in TANF spending just for child welfare.

TANF’s Child Welfare Role: TANF plays a major role in child welfare financing, supporting an array of activities, including:

Financial resources for kin caregivers

Foster care maintenance payments for children who are not eligible for Title IV-E.

Family support, family preservation, and reunification services;

Adoption services; and

Much more, including the authority to transfer up to 10% of TANF funds to SSBG, which itself can also fund child welfare activities.

The breadth of things TANF does in child welfare points both to its evolution within the basic assistance eligibility constraints, and the limits of other federal funds.

These broad activities include both unique and overlapping functions to other federal

CWW Original Analysis

FY23 TANF Child Welfare Expenditure Data

This is Child Welfare Wonk; we couldn’t help but notice that these extensive new GAO reports only go up to FY2022 data.

ACF has FY2023 TANF expenditure data too though, so we had to dig in and add to what GAO has offered.

Fifteen with One-Fifth

This chart shows the 15 states that have 20 percent or more of their FY2023 TANF expenditures going to child welfare1:

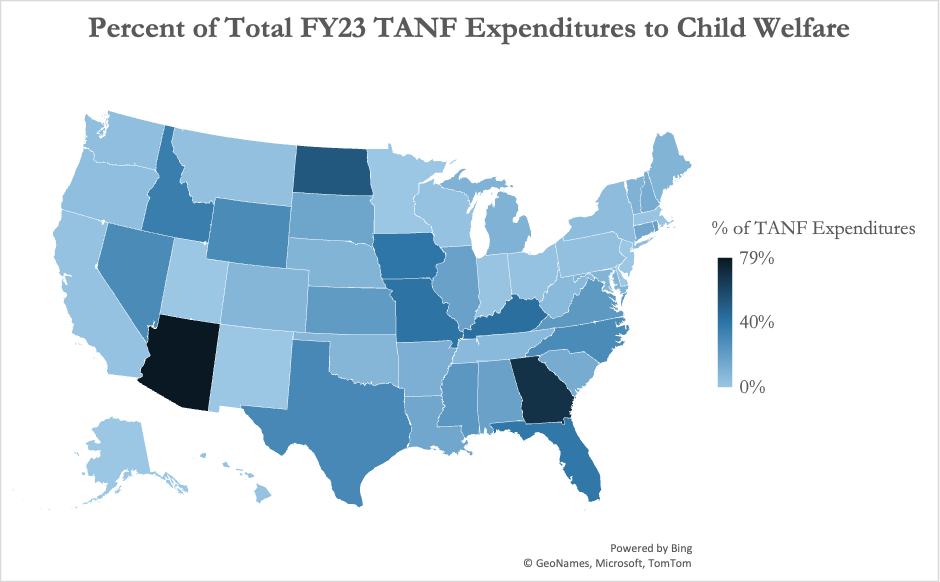

To add some national perspective, this map shows the percent of total FY2023 TANF expenditures that went to child welfare.

What it Means for Child Welfare Policy: Changes to TANF in budget reconciliation or from staff reductions would have significant child welfare financing implications.

Long-term, the evolving changes across federal financing programs raise questions about bipartisan opportunities to optimize operation across all federal programs.

For interested Wonks, our analysis specifically pulled the total (i.e. federal and state) expenditures for these categories:

6.b. Basic Assistance -

Relative Foster Care Maintenance Payments and Adoption and Guardianship Subsidies

7.a. Assistance Authorized Solely Under Prior Law -

Foster Care Payments

8.a. Non-Assistance Authorized Solely Under Prior Law -

Child Welfare or Foster Care Services

20.a.Child Welfare Services-Family Support/Family Preservation /Reunification Services

20.b.Child Welfare Services-Adoption Services

20.c.Child Welfare Services- Additional Child Welfare Services