Medicaid Cuts in Reconciliation Reality

Plus AFCARS gets data dash glow up, TANF reform bills, & more....

Welcome, Wonks!

The White House has proclaimed May National Foster Care Month. It celebrates the Family First Prevention Services Act and the First Lady’s Be Best campaign.

The First Lady’s office is also highlighting her role in the President’s FY26 Budget Request including $25 million for housing and support for youth aging out of care.

Featured Child Welfare Wonk Partner:

About Think of Us: “We’re a research and design lab for the social sector, working to transform child welfare. Led and guided by people who have been directly impacted by this system, we are a trusted partner across the national child welfare field. We work with government agencies, lawmakers, providers, advocates, and foundations to drive novel, scalable solutions at the federal, state, and local levels.”

Email RE: Child Welfare Research to Cut

An inadvertent email has publicized a list of child welfare and early childhood research projects HHS has slated for elimination. The AP has noted that:

“A spokesperson for HHS said the list contained “outdated and pre-decisional information” but did not deny that some grants could be cut.”

Notable for child welfare research is the proposed elimination of projects on the:

Family First Prevention Services Act: 7 prevention evaluations;

Incidence of child maltreatment: Two analyses of data from the National Incidence Study under the Child Abuse Prevention and Treatment Act; and

Economic mobility: Five projects supporting a network of scholars examining family self-sufficiency and stability.

The list also includes dozens of studies related to Head Start and child care.

Why it Matters: Data like these have previously informed bipartisan policymaking, flowing into the development of new legislative proposals.

Family First and policies like TANF are of perennial interest to policymakers and the subject of ongoing reform deliberations. How will less data and analysis change that?

Reconciling Reconciliation Reality

After beaucoup delays, we have budget reconciliation text and markups to discuss.

Reminder on Reconciliation: Our reconciliation overview explains how this fast-track simple-majority legislative process works.

It matters for child welfare since it could include funding cuts and policy changes for:

Medicaid;

the Social Services Block Grant (SSBG); and

Temporary Assistance for Needy Families.

What’s New: The U.S. House Ways and Means Committee and U.S. House Energy and Commerce Committee1 have released budget reconciliation legislative text.

They are both planning to mark up their bills on May 13, holding committee-level votes on both proposals and any amendments to them that come up.

Last week’s Wonk analyzed the dynamics that led to delays of the markup of core aspects of budget reconciliation related to Medicaid, SSBG, and TANF.

This week, we dig into what’s up for discussion. The big caveat here is that this is all in pencil; negotiations are ongoing and none of this is settled or finalized.

Topline, Medicaid still faces significant cuts. SSBG and TANF are not implicated in the text, though that could always change with amendments.

Medicaid Cuts and Changes, Structure Stays

The Energy and Commerce legislation would make significant cuts and changes to Medicaid and other health programs. These changes include:

Total Health Spending Cut of $714B

Work Verification & Cost Sharing

The bill would mandate new requirements on most beneficiaries to prove they are working, and add cost sharing like co-pays to Medicaid.

This could introduce new challenges for youth aging out of foster care, and parents receiving services to avoid foster care placement.

Limits State Financing Mechanisms

Ceilings on service payments at Medicare rates and eliminating provider taxes.

This could erode sustainable service networks for child welfare-related services like behavioral health, for which states often pay extra.

Cuts to Funds for States Over Immigrant Coverage

The proposal would reduce federal reimbursement for the Medicaid expansion to 80% for states who cover undocumented immigrants.

This could create significant shortfalls for states like CA, IL, NY, and more.

The bill does not currently include fundamental structural changes like per-capita caps on spending. All of this of course could continue to change.

SSBG/TANF Silence

The Ways and Means legislation focuses on tax policy, making permanent the individual tax rate reductions and changes from the 2017 Tax Cuts and Jobs Act.

The bill includes a temporary increase of the Child Tax Credit, from $1,000 to $2,500 through 2028.

The increase is nonrefundable; funds would not be available for the lowest income families who pay no or low taxes. It would require Social Security Number verification.

Notable Exclusions: Wonks may wonder; if there are not cuts to SSBG and TANF in this text, are they off the table?

Not necessarily. It’s possible we could see those changes via amendments in committee, or later. Their absence here is noteworthy, but a dynamic to watch.

What Comes Next

This week’s markups are a key test of what policies can garner the votes needed to proceed further in the reconciliation process.

The timing to watch continues to be the debt limit, which reconciliation would raise.

U.S. Treasury Secretary Scott Bessent sent this letter to U.S. House Speaker Mike Johnson (R-LA) on May 9.

Rather than a firm debt limit data, it argues for lifting before August recess, noting:

“… [T]here is a reasonable probability that the federal government's cash and extraordinary measures will be exhausted in August while Congress is scheduled to be in recess. Therefore, I respectfully urge Congress to increase or suspend the debt limit by mid-July, before its scheduled break, to protect the full faith and credit of the United States.”

The big question on substance is whether the House majority can agree on these proposals, which lean toward moderates concerned about cuts to Medicaid.

Reconciliation remains in early stages, but the approach is much clearer with the release of text. We will continue to break down what it means for child welfare for you.

When you make budget brisket, the proof is in the eating. What remains to be seen is who gives compliments to the chef, and who sends their plate back untouched.

Proposed TANF Limits & Child Welfare

U.S. House Ways and Means Majority Members have proposed seven bills to reform Temporary Assistance for Needy Families (TANF), with child welfare implications.

Context: These proposals are aimed at reforming TANF, in response to recent U.S. Government Accountability Office reports on program accountability and outcomes.

Background: TANF's structure includes “assistance” (direct financial support) and “non-assistance” (everything else).

Complex eligibility rules for assistance drive increasing shifts toward non-assistance.

Proposed Bills: The proposed bills include income limits for non-assistance, expanding work reporting and requirements, and new oversight requirements.

Considered together as a package, they would:

Restrict the allowed uses of TANF;

Prioritize and expand the focus on employment; and

Reduce TANF flexibility and expand centralized federal oversight.

Child Welfare & Non-Assistance: Child welfare purposes are a key element of TANF, many of which fall into the non-assistance category.

In real people speak this looks like paying for foster care that Title IV-E doesn't cover, family preservation services, child protective services, and more.

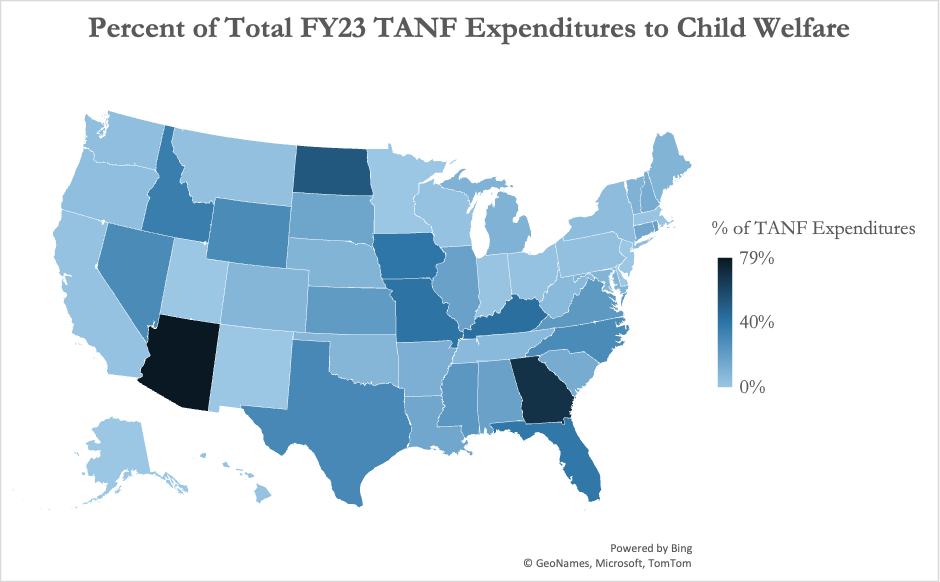

This map shows the percentage of TANF expenditures related to child welfare policy, which range as high as nearly 4/5 for some states.

This chart outlines the states where 20% or more of TANF spending goes to child welfare purposes.

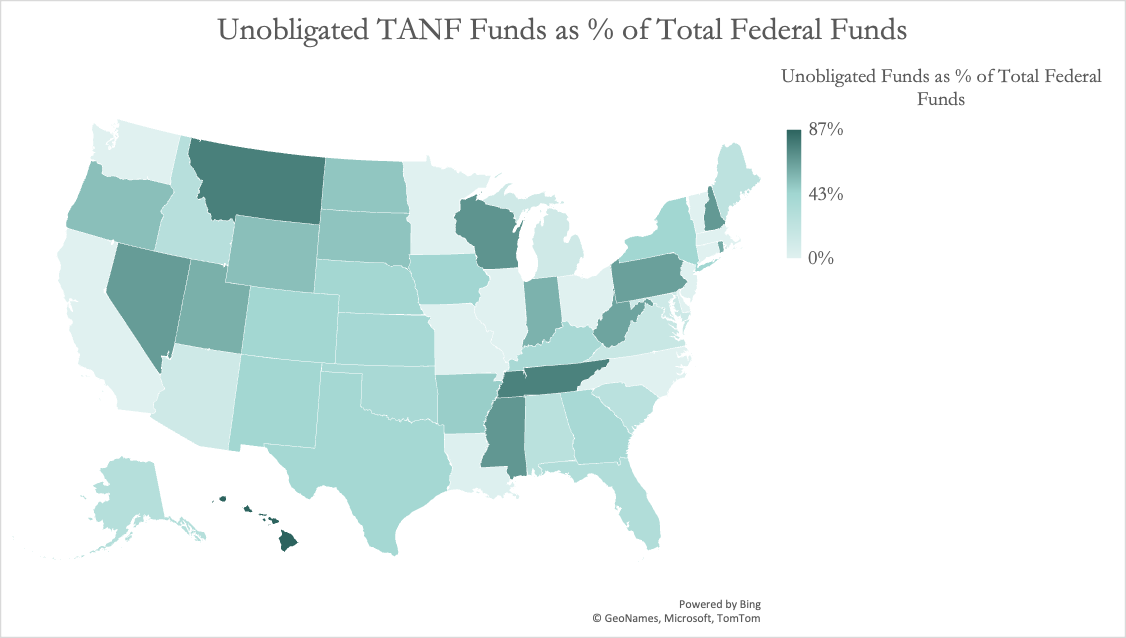

Much Obliged: Another wrinkle to TANF spending is so-called “unobligated” funding. States can roll funds over that they don’t use, and hold them in reserve.

A core reason funds end up in this unobligated category is that the rules for economic assistance disincentivize that use, leading to accrual of reserves.

You can see with this map how significant that is:

Here are states whose unobligated funds are half or more of total federal funding.

Among other policies considered in these proposals are limits on the rollover of these funds and uses for non-assistance purposes.

What it Means for Child Welfare: There are important considerations for child welfare policy across these bills, including:

How does reduced flexibility limit funding for family preservation and kinship care?

How would expanded administrative and compliance oversights work during a period of reduced federal workforce and technical assistance?

How would policymakers consider the current role TANF plays in funding child welfare systems and services?

Many of the child welfare uses of TANF reflect workarounds to limits in other major child welfare financing streams and TANF itself.

It’s worth considering what it would look like if we started from scratch today…

AFCARS is Getting a Dashboard

Child Welfare Wonk readers, rejoice! The Adoption and Foster Care Analysis and Reporting System (AFCAFS)is getting a major overhaul, from PDFs to data dashboard.

AFCARS: AFCARS provides insight into demographics and other important characteristics related to children who enter the child welfare system.

Currently, it’s a series of annual PDF reports, alongside downloadable excel files.

What’s New: Acting ACF Assistant Secretary Andrew Gradison announced that ACF will release a new AFCARS that works as an interactive data dashboard.

This will occur alongside the new FY2023 data release. In the announcement, ACF noted that the latest data indicate the

Entries: Foster care entries dropped 6.1% from FY2022, to 175,283.

Children in Care: 337,077 on September 30, 2023, down 6.9% from FY2022.

What Next: ACF will hold an instructional webinar on May 13 to release the dashboard, which will go live here.

More detailed analyses will be forthcoming, including how much of that specifically is Medicaid.