Will Anything Ever Change for TANF?

By Doug Steiger, MPP, Child Welfare Wonk Senior Contributor

Will Anything Ever Change for TANF?

By Doug Steiger, Child Welfare Wonk Senior Contributor

TANF’s history drives its current challenges, and its obstacles to evolution

If you blinked, you might’ve missed the last time TANF had a serious moment in the political spotlight.

Born in the wake of innovative Aid to Families with Dependent Children (AFDC) waivers, TANF initially looked like a success as the welfare caseload melted away, aided by the booming 1990s economy.

With that perceived success came a loss of political interest. The “problem” had been solved.

Since then, cash welfare has rarely commanded attention. SNAP and Medicaid took center stage. TANF faded into the policy background.

The Quiet Block Grant

TANF—Temporary Assistance for Needy Families—is the $16.5 billion per year block grant that replaced the 60-year-old AFDC program back in 1996.

TANF was meant to promote work and reduce dependency, and it gave states great flexibility in how they spend funds in return for meeting work requirements.

But nearly three decades in, TANF has drifted out of the spotlight. With little federal oversight and no inflation adjustment since its creation, the block grant has lost over 40% of its value in real dollars.

Able to largely meet the work participation requirements through smaller caseloads and with cash welfare no longer an important political issue, states have looked to flexible TANF funds as a source to meet other social service needs.

States have repurposed the funding to plug budget holes or support other priorities—child welfare chief among them.

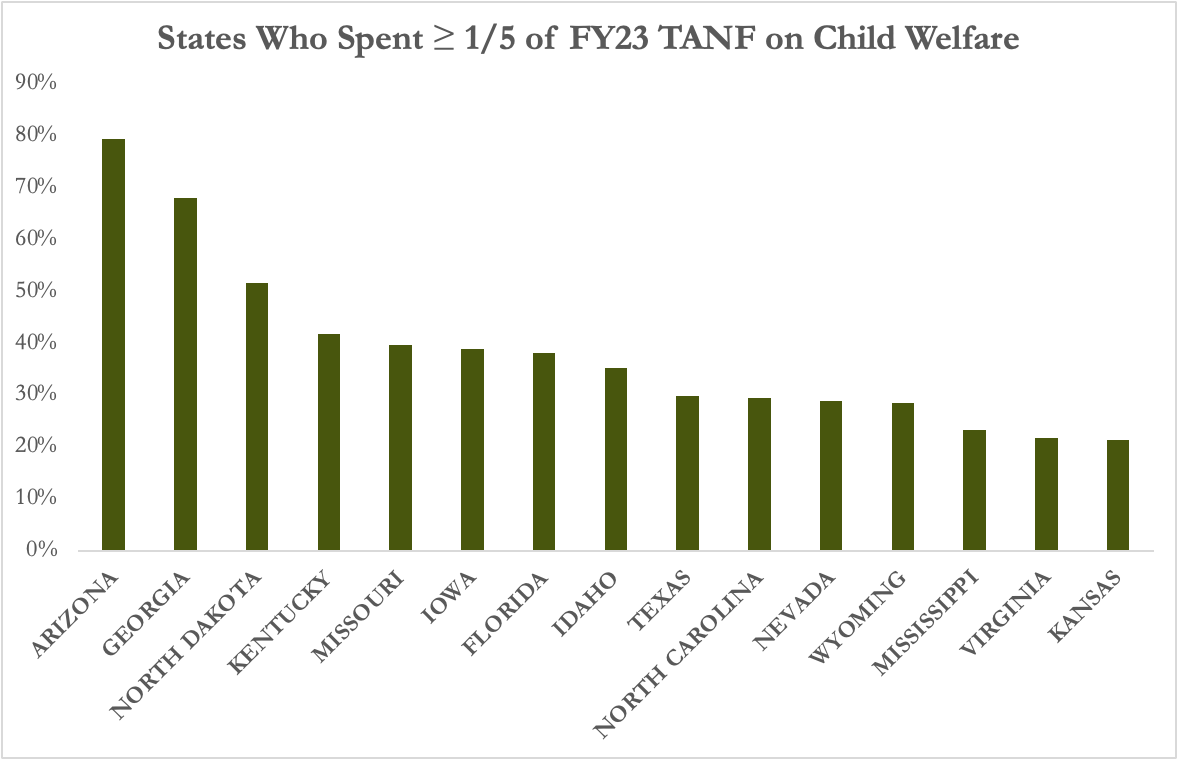

15 states spend one-fifth or more of their TANF funds on child welfare, ranging from 20 percent in Kansas and Virginia to percent almost 80 percent in Arizona (see Table).

States now spend only about one-third of TANF on cash aid or job training programs.

It has been easier to meet the work participation requirements through smaller caseloads than large-scale investments in welfare-to-work programs and increasing cash benefits is rarely popular, even if their value has diminished over the years.

Meanwhile, the safety net shrinks: fewer than one-quarter of poor families receive cash benefits, down from two-thirds under AFDC.

Pilots for Progress?

In 2023, Congress authorized bipartisan pilot projects to test new accountability approaches—less about activity, more about outcomes.

The idea: move beyond process measures like “participated in work activity” to actual results like “got a job” or “increased earnings.”

In November 2024, the Department of Health and Human Services (HHS) awarded pilots to five states after a competitive process where nearly half the states submitted proposals.

These states – Kentucky, Ohio, California, Maine, and Minnesota – were to spend FY 2025 negotiating the details of their accountability measures.1

But in March, HHS canceled the pilots. The rationale? The original selection criteria weren’t aligned with the Trump Administration’s priorities. Applications were due by August 15, 2025.

We will see if they also select pilots with negotiated employment-related benchmarks. A main difference is the metrics would now emphasize achieving employment goals without families continuing to receive other forms of benefits, such as SNAP and Medicaid, something the previous iteration did not consider problematic.

Congressional Drift—or Drive?

In a rational policy process, Congress would wait for pilot results before reforming TANF. But five years is a long time to wait.

In April, Ways & Means Republicans held a subcommittee hearing on TANF. In May, they introduced the JOBS for Success Act , echoing some of the pilots themes. .

The bill would:

Replace the current work participation requirements with a “universal engagement and case management” requirement for adults on TANF;

Hold states to negotiated benchmarks for employment and earnings for those leaving TANF;

Require TANF funds spent on child care and early childhood programs to be transferred to those programs rather than being spent directly; and,

Mandate that at least 25% of TANF funds support “core” activities of job training, case management, and “work supports.”

This could put pressure on child welfare financing in states where TANF has been an important source of child welfare funding.

Some elements of this bill are similar to pilot proposals selected in 2024.

Is Change Coming?

The House Republicans could have folded TANF provisions into the One Big Beautiful Bill Act (OBBBA), but they didn’t, likely because reconciliation rules might’ve blocked some proposals.

This suggests that TANF reform is not a top-tier priority. But now with the OBBBA done, Ways & Means may turn its attention back to a TANF bill.

In particular, if House Republicans believe “welfare reform” still plays well politically, it may be something that moves next year as the election nears.

But Ways & Means also oversees tax, trade, and Medicare. TANF will be jockeying for floor time.

So far, the Senate has shown little appetite for TANF reform. But if the House acts, that could change.

For those interested in – at long last – significant changes to TANF, keep an eye on two things:

Who gets selected in the re-run of the pilot program with what metrics for success.

Whether the Ways & Means Republicans ramp up work on legislation.

Democrats have been more interested in expanding the child tax credit as a way to support low-income families than revisiting TANF and its issues.

Doug Steiger is a Child Welfare Wonk Senior Contributor and public policy consultant.

He served as a Counselor to the HHS Secretary during the Obama Administration and was a Senate staffer for 12 years

Full disclosure: I was a consultant to HHS for this process.